Bedford Row Capital offers a complete origination and syndication solution for the issuance of high yield bonds, green bonds, short-term commercial paper and Sukuk.

Bedford Row Capital connects investors to bankruptcy-remote structures that offer a clear line of sight to assets and security. Exchange listings include transparent pricing and secondary market (UCITs eligible assets).

Bedford Row Capital offers investors uncorrelated opportunities outside of local markets, which provide exposure to SME financing, UK real estate, Australian Mining, supply chain finance, ESG & SDG impact investing, and more.

Bedford Row Capital is an award-winning, non-bank originator that exists to serve a diverse range of firms who are unable to access the services of banks and want to raise finance in the debt capital markets.

Through insight and innovation Bedford Row Capital provides borrowers with a streamlined process while reducing costs, and giving investors access to yield and liquidity.

Asset agnostic experience in multiple asset classes including real estate, renewable energy, mining, shipping, aviation, trade finance and more.

In view of the lack of universally accepted guidelines, Bedford Row Capital aims to assist investors and borrowers with best practice and market intelligence.

Sukuk has diversified into non-traditional sectors and is a vibrant and evolving sector adapting to investor demand for liquidity.

In a zero yield world, Insured Money Market Certificates provide cash management with a positive return on a fixed date, fixed rate basis.

Award-winning leader in origination and structuring in the CP market and Bloomberg consistently ranks us in the top 100 arrangers

Bedford Row Capital has experience in multiple asset classes, including and not limited to real estate, renewable energy, mining, shipping, aviation and trade finance.

In view of the lack of universally accepted guidelines, our aim is it to assist investors and borrowers with market intelligence and best practice.

With the importance of ESG as an investment theme, Bedford Row Capital is an active participant in a number of key initiatives led by our Head of Social Policy.

To enhance transparency and security for both investors and insurers, we have built a dashboard with proprietary technology. The dashboard is up to date in accordance with the principles of the “Look Through Approach” set out in various regulations which include Solvency II, capital adequacy rules, and BIS capital retention rules.

The management team includes experience across all aspects of debt capital markets and financial services, including actuarial, underwriting, insurance (life and non-life), equity capital markets, fund management and conduit programmes.

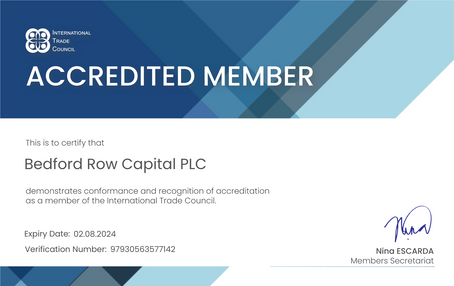

Memberships and Affiliations

Bedford Row Capital proudly holds a membership with the International Trade Council, solidifying our position as a distinguished leader in the industry. This affiliation exemplifies our dedication to global connections, business excellence, and nurturing valuable partnerships. As we further enhance our presence, this membership serves to fortify our role at the forefront of innovation and collaboration.

CREST Participant ID: BO01

CREST Member ID: 1

Euroclear ID: 78009

The information provided in this website has been prepared by Bedford Row Capital PLC (the "Company") for professional clients and eligible counter-parties only as defined by Markets in Financial Instruments Directive 2004/39/EC. These pages are not available to retail clients and retail clients should not rely on the information contained therein. Access to this website does not constitute the creation of a client relationship and no such responsibility should be inferred. The information, material and applications presented in this website are provided to you for information purposes only and nothing contained on this website is, or should be considered as, an offer or a solicitation to sell or an offer or solicitation to purchase any of the products described on this website. The products described on this website are not likely to be available for purchase for all investors in all jurisdictions. The Company does not provide advice nor does it act in a manner which could be deemed to be regulated in any jurisdiction. The information provided on this website is not, and may not be construed as constituting, investment advice or any form of recommendation as regards either individual products or strategies for investors. Before undertaking any transaction, you must seek professional advice. All investments are governed by their relevant terms and conditions and prospectus and these should be read carefully. This is not an unusual provision but one which most people ignore. We strongly suggest that you carefully consider your position with regards to tax and other matters before undertaking any financial activities. Your use of this site is governed by this disclaimer.

Copyright Bedford Row Capital Advisers PLC. 2023 @ All Rights Reserved